What Is Cac In Real Estate

What Is Cac In Real Estate : A Comprehensive Guide

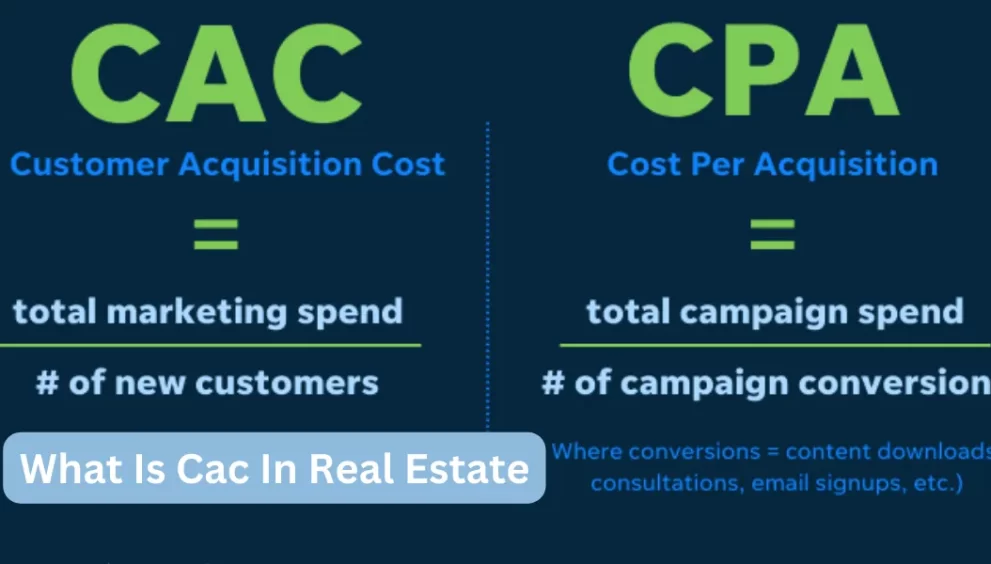

What Is Cac In Real Estate ? In the realm of real estate, it is essential for professionals to understand and leverage various metrics to drive business success. One such crucial metric is CAC, which stands for Customer Acquisition Cost. CAC measures the cost incurred to acquire a new customer or client in the real estate industry. This comprehensive guide will delve into the significance of CAC, its calculation, and strategies for optimizing it in line with Google SEO rules.

What Does CAC Stand for in Real Estate?

CAC, or Customer Acquisition Cost, refers to the total amount of money a real estate business invests in marketing and sales activities to acquire a new customer. It encompasses various expenses such as advertising costs, lead generation efforts, marketing campaigns, sales team salaries, and other related expenditures.

Importance of CAC in Real Estate Marketing Strategies

Understanding CAC is vital for real estate professionals as it allows them to assess the effectiveness and efficiency of their marketing strategies. By calculating CAC, businesses can evaluate the return on investment (ROI) for their customer acquisition efforts. It helps in determining the profitability of specific marketing channels and aids in making informed decisions regarding resource allocation.

Calculating CAC: Key Metrics for Real Estate Professionals

To calculate CAC accurately, real estate professionals must consider several key metrics. The first step involves identifying all the marketing and sales expenses directly associated with customer acquisition. These may include advertising costs, website development, lead generation tools, and personnel salaries.

Next, divide the total acquisition expenses by the number of new customers acquired within a specific timeframe. For instance, if a real estate business spent $10,000 on acquisition efforts and gained 20 new customers in a month, the CAC would be $500 ($10,000 / 20).

The Role of CAC in Assessing Real Estate Investments

CAC plays a crucial role in evaluating the feasibility and profitability of real estate investments. By considering the acquisition cost alongside other financial factors, investors can determine the viability of acquiring a property. This assessment helps in estimating potential returns and understanding the overall financial impact of a real estate investment.

Effective CAC Management Techniques for Real Estate Businesses

Real estate businesses can employ several techniques to manage and optimize their CAC effectively. Firstly, conducting a thorough analysis of different marketing channels and identifying the ones that yield the highest-quality leads can help focus resources on the most effective channels. Additionally, implementing customer segmentation strategies enables tailored marketing approaches, which can enhance conversion rates and reduce CAC.

Regular monitoring and tracking of CAC metrics is essential to identify trends and make data-driven decisions. By leveraging technology and analytics tools, real estate professionals can gain valuable insights into customer behavior, marketing campaign performance, and overall CAC efficiency.

Enhancing Profitability through CAC Optimization in Real Estate

By optimizing CAC, real estate businesses can enhance their profitability. One approach is to improve the conversion rate by refining the lead nurturing process, streamlining sales funnels, and providing exceptional customer service. Investing in targeted advertising campaigns and maximizing organic search engine optimization (SEO) techniques can also generate high-quality leads while reducing CAC.

Furthermore, building long-term relationships with customers through effective customer retention strategies can significantly impact CAC. Loyal customers tend to refer new clients, thereby reducing the need for extensive acquisition efforts and lowering CAC in the long run.

CAC vs. LTV: Balancing Customer Acquisition Costs with Lifetime Value

When analyzing CAC, it is crucial to consider the Lifetime Value (LTV) of customers. LTV represents the total revenue generated from a customer throughout their engagement with a real estate business. Balancing CAC and LTV ensures that customer acquisition costs do not outweigh the potential value generated over the customer’s lifetime. Striking this balance is essential for sustainable growth and profitability.

Leveraging Digital Marketing Channels to Reduce CAC in Real Estate

In today’s digital era, real estate businesses can leverage various online channels to reduce CAC effectively. Establishing a strong online presence through search engine optimization (SEO), content marketing, social media marketing, and paid digital advertising can attract qualified leads at a lower cost. Engaging with potential customers through valuable content, virtual tours, and interactive experiences can help build trust and increase conversion rates while minimizing CAC.

Case Studies: Successful CAC Implementation in Real Estate

Examining real-world case studies can provide valuable insights into successful CAC implementation in the real estate industry. By studying the strategies and tactics employed by industry leaders, real estate professionals can gain inspiration and adapt proven methodologies to their own businesses. Case studies offer practical examples of how optimizing CAC can lead to increased customer acquisition, improved ROI, and sustainable growth.

Understanding and effectively managing CAC is crucial for real estate professionals seeking growth and profitability. By employing the right strategies, leveraging digital marketing channels, and analyzing key metrics, businesses can optimize CAC, reduce customer acquisition costs, and drive long-term success in the competitive real estate industry.

Click here for more visited Posts!