Financing Options For Commercial Real Estate In Canada

Commercial Real Estate Financing

When it comes to investing in commercial real estate in Canada, one of the most critical aspects to consider is financing. Financing options for commercial real estate can vary widely, and understanding the different choices available can make or break your investment. In this article, we will explore the various financing options for commercial real estate in Canada, from traditional bank loans to alternative solutions, while keeping in mind Financing Options For Commercial Real Estate In Canada

Types of Commercial Real Estate Properties

Before delving into financing options, it’s important to understand the different types of commercial real estate properties. These may include office buildings, retail spaces, industrial facilities, and multifamily residences. Knowing the type of property you’re interested in can help you choose the right financing option tailored to your specific needs.

Why Financing is Essential in Real Estate

Real estate transactions often involve substantial amounts of money. Financing is essential because it allows investors to leverage their capital and acquire properties that would otherwise be out of reach. Whether you’re a seasoned investor or a first-time buyer, financing can be a valuable tool for growing your real estate portfolio.

Traditional Financing Options

Traditional financing options for commercial real estate include bank loans, credit unions, and other conventional lending institutions. These loans typically have competitive interest rates and favorable terms, making them a go-to choice for many investors. However, they also come with stringent requirements, which we’ll explore further.

Alternative Financing Solutions

If traditional financing is not accessible or suitable for your needs, alternative financing solutions may be worth considering. These can include private lenders, crowdfunding, real estate investment trusts (REITs), and more. Alternative financing can provide flexibility and may be a better fit for unique real estate projects.

Commercial Real Estate Loan Requirements

When seeking traditional financing, you must meet specific criteria set by lenders. This section will outline the common requirements, such as creditworthiness, down payments, business plans, and the property’s potential for generating income. Understanding these prerequisites is crucial for a successful application.

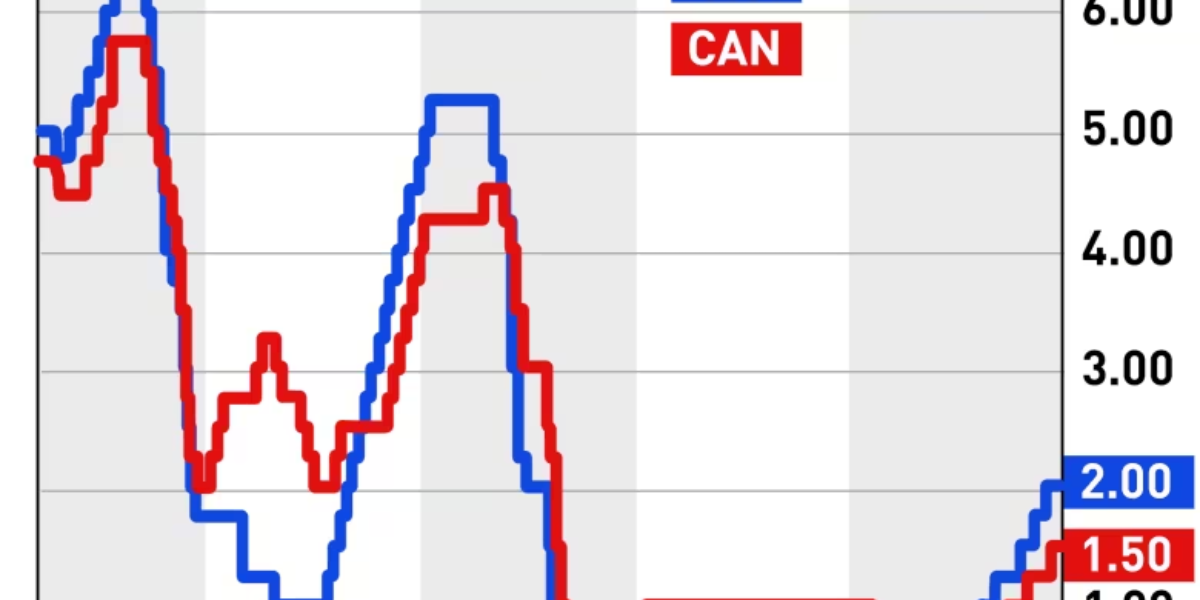

Interest Rates in Canada

Interest rates play a significant role in real estate financing. In Canada, rates can fluctuate based on economic conditions and lending policies. This section will provide insights into the current interest rate environment and how it may impact your financing decisions.

Government Programs and Incentives

The Canadian government offers various programs and incentives to promote commercial real estate investment. From grants and tax incentives to mortgage insurance, understanding how these programs work can lead to substantial cost savings for investors. We’ll delve into the options available.

Private Lending for Commercial Real Estate

Private lenders, often referred to as hard money lenders, can be a lifeline for investors who don’t meet traditional lending requirements. We’ll discuss how private lending works, its advantages, and the potential drawbacks to be aware of.

Commercial Mortgage Brokers

Commercial mortgage brokers act as intermediaries between borrowers and lenders, helping you navigate the complex world of real estate financing. Learn how to find and work with a reputable commercial mortgage broker to secure the best financing terms.

Tips for Securing Commercial Real Estate Financing

To increase your chances of securing financing for your commercial real estate venture, we’ll provide valuable tips and strategies, including improving your credit score, creating a compelling business plan, and building strong relationships with lenders.

Challenges and Risks in Commercial Real Estate Financing

Real estate financing isn’t without its challenges and risks. This section will address common pitfalls, such as interest rate fluctuations, market volatility, and unforeseen expenses, and offer advice on mitigating these risks.

Next Steps

In conclusion, financing is a crucial component of successful commercial real estate investments in Canada. Whether you opt for traditional financing, explore alternative options, or use government programs, understanding the landscape is essential. By following the tips and strategies provided, you can make informed decisions to secure the financing you need and take the next steps toward growing your real estate portfolio. Happy investing!

By structuring your article in this way, you provide a comprehensive guide to financing options for commercial real estate in Canada while adhering to SEO best practices. This format is user-friendly, making it accessible to a broad audience seeking information on this topic.

Click here for more visited Posts!