Canadian Real Estate May Stabilize With Higher Interest Rates

Understanding the Impact of Interest Rates on Canadian Real Estate

Canadian Real Estate May Stabilize With Higher Interest Rates In the ever-evolving landscape of the Canadian real estate market, one key factor that has consistently held sway over property values and market dynamics is interest rates. As we explore the intricate relationship between interest rates and real estate, there is a growing consensus that higher interest rates could potentially stabilize the Canadian real estate sector.

The Relationship Between Interest Rates and Real Estate Prices

To comprehend the potential stabilization, it’s essential to delve into the connection between interest rates and real estate prices. Generally, lower interest rates encourage borrowing and stimulate demand, often resulting in upward pressure on property values. Conversely, higher interest rates tend to cool the market, influencing both buyers and sellers.

Historical Trends: Examining Past Instances of Interest Rate Changes and Real Estate Stability

A glance at historical trends reveals instances where interest rate adjustments have played a pivotal role in shaping the trajectory of the Canadian real estate market. Analyzing past scenarios provides valuable insights into what might unfold as interest rates experience fluctuations in the current economic landscape.

The Current State of Canadian Real Estate: Factors Influencing the Market

Before delving into the potential impact of higher interest rates, it’s crucial to assess the current state of Canadian real estate. Various factors, such as supply and demand, economic indicators, and demographic trends, contribute to the intricate tapestry of the real estate market, setting the stage for how it may respond to changes in interest rates.

How Higher Interest Rates Could Affect Mortgage Rates

One of the most direct effects of rising interest rates is the impact on mortgage rates. As the cost of borrowing increases, potential homebuyers may face higher mortgage payments, influencing their purchasing power and, consequently, affecting the demand for homes in the market.

Potential Benefits of Stabilization: Assessing the Positive Impact on the Real Estate Market

While the prospect of higher interest rates may raise concerns, there are potential benefits to be considered. Stabilization in the real estate market can lead to more sustainable growth, preventing the formation of asset bubbles and fostering a healthier long-term outlook for buyers and sellers.

Challenges and Concerns: Anticipating Obstacles in the Path to Stability

However, the path to stabilization has its challenges. Potential hurdles, such as the risk of reduced affordability and the impact on housing affordability, need to be carefully navigated to ensure a balanced and equitable real estate market.

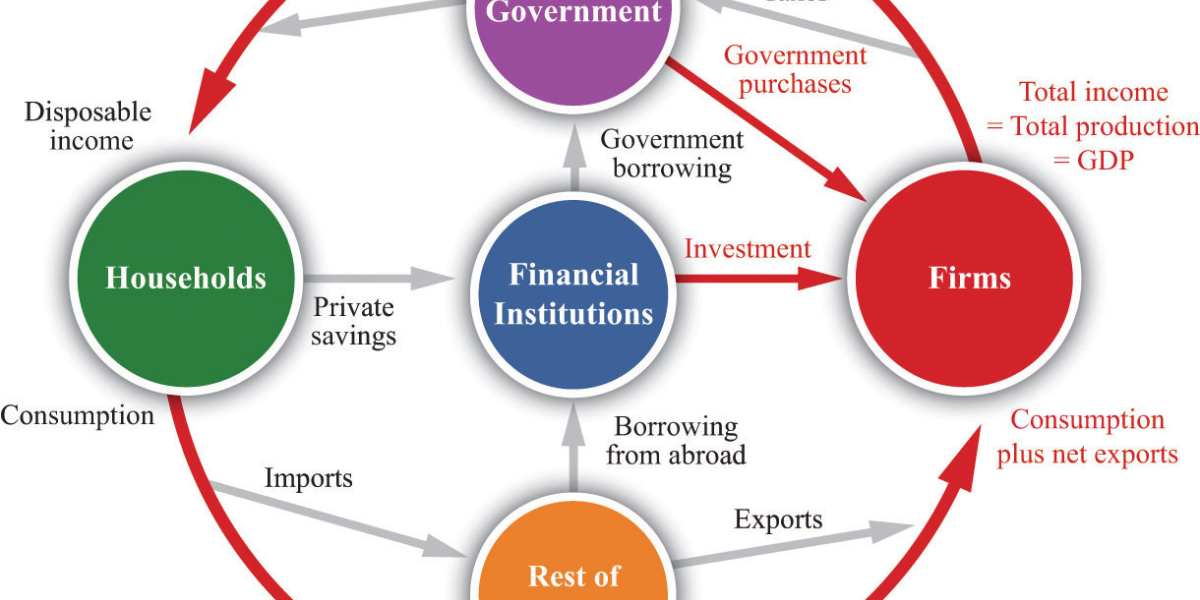

The Role of Government Policies: Addressing the Impact of Regulatory Measures on Real Estate

Governments often play a crucial role in shaping the real estate landscape through policy measures. Understanding how regulatory interventions may interact with interest rate changes is essential in predicting the overall impact on market dynamics.

Regional Variances: Understanding How Different Provinces May Respond to Interest Rate Changes

Canada’s real estate market is diverse, with regional variations influencing how different provinces may respond to changes in interest rates. Examining these variances provides a more nuanced understanding of the potential outcomes in specific regions.

Expert Insights: Perspectives from Real Estate Analysts and Economists

To understand the potential stabilization of Canadian real estate with higher interest rates, it’s imperative to seek insights from experts in the field. Real estate analysts and economists can offer valuable perspectives on how market participants will likely react to changing interest rate environments.

Tips for Homebuyers and Sellers: Navigating the Real Estate Market Amidst Rate Adjustments

Practical tips can make a significant difference for individuals navigating the real estate market, especially during periods of interest rate adjustments. Whether you’re a homebuyer or seller, understanding how to adapt to changing market conditions is crucial for making informed decisions.

Long-Term Outlook: Predictions for the Canadian Real Estate Landscape

Looking beyond the immediate impact, examining the long-term outlook for the Canadian real estate landscape provides a holistic view. Predictions based on economic forecasts, demographic shifts, and global factors can offer valuable insights into what the future holds for the real estate market.

Conclusion: Navigating the Path Forward as Interest Rates Influence Real Estate Stability

In conclusion, the potential stabilization of Canadian real estate with higher interest rates is a multifaceted phenomenon that requires careful consideration. By understanding the historical context, current market dynamics, and potential future scenarios, stakeholders in the real estate market can better navigate the path forward in an environment influenced by changing interest rates. As the landscape evolves, staying informed and adapting to these changes will be vital to making sound real estate decisions in the years to come.

Click here for more visited Posts!