Are First Time Home Buyers In BC Struggling To Buy A Home?

Purchasing a first home is a monumental milestone, but for many prospective homeowners in British Columbia (BC), the journey is becoming increasingly challenging. This article delves into the current struggles faced by first-time home buyers in BC,Are First Time Home Buyers In BC Struggling To Buy A Home?

The Current Real Estate Landscape in BC

Before exploring the challenges, it’s crucial to understand the present state of the real estate market in BC. Analyzing housing trends, price fluctuations, and demand-supply dynamics sets the stage for comprehending the hurdles faced by first-time buyers.

Affordability Challenges for First-Time Home Buyers

Affordability remains a critical concern for first-time home buyers in BC. Rising housing prices, coupled with economic uncertainties, create a daunting scenario for those aspiring to own a home. We’ll explore the specific factors contributing to this affordability crisis.

Government Initiatives and Policies

Governments play a pivotal role in shaping the real estate landscape. This section evaluates the initiatives and policies implemented by the BC government to alleviate the challenges faced by first-time home buyers. Understanding these measures is crucial for prospective homeowners.

Mortgage Options for First-Time Buyers

Navigating the mortgage market can be overwhelming for first-time buyers. This section breaks down the mortgage options available in BC, shedding light on interest rates, repayment terms, and other essential factors that influence home financing decisions.

Rising Housing Prices: A Major Hurdle

The surge in housing prices poses a significant obstacle for first-time buyers. We explore the factors driving this upward trend and its implications on the affordability of homes in BC.

Impact of Interest Rates on Home Affordability

Interest rates play a pivotal role in determining the cost of homeownership. Here, we examine the relationship between interest rates and home affordability, offering insights into how fluctuations can affect first-time buyers.

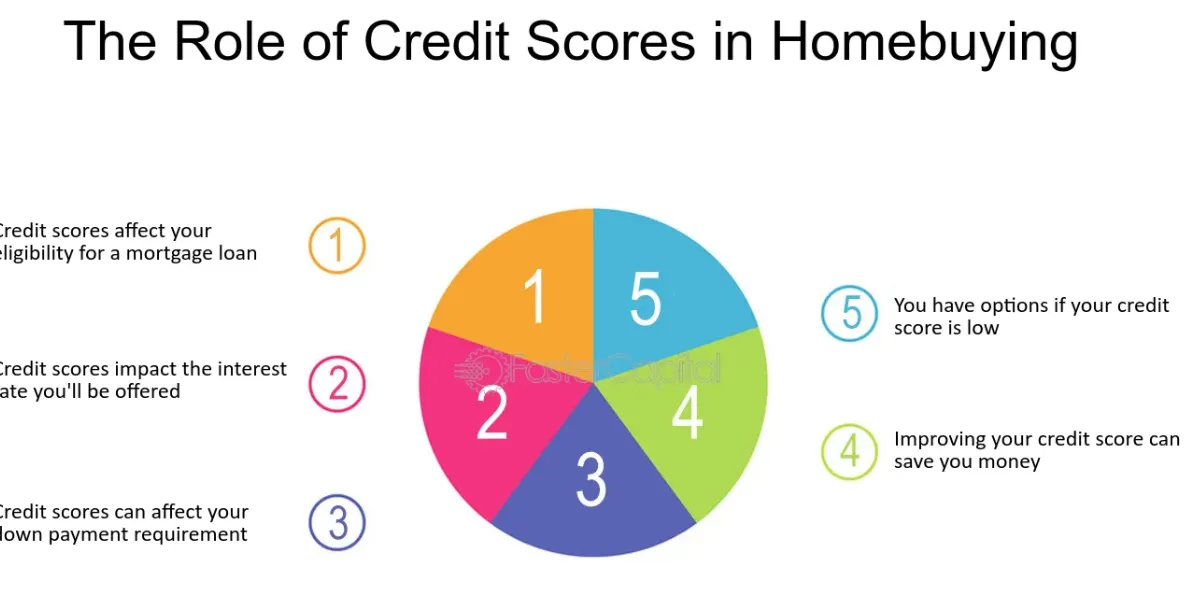

The Role of Credit Scores in Homebuying

Credit scores are a crucial aspect of the homebuying process. This section outlines the significance of a good credit score, its impact on mortgage approval, and strategies for first-time buyers to enhance their creditworthiness.

Down Payment Dilemmas: Saving Strategies

Saving for a down payment is a common challenge for first-time home buyers. We explore practical strategies for saving, government assistance programs, and alternative approaches to overcome the down payment dilemma.

Homebuyer Education Programs

Education is key to making informed decisions. This section highlights the importance of homebuyer education programs, providing valuable resources and insights to empower first-time buyers in their journey.

Real Estate Market Trends and Predictions

Staying informed about market trends is essential for prospective home buyers. We delve into the current real estate market trends in BC and offer predictions to help first-time buyers make well-informed decisions.

Tips for First-Time Home Buyers

Arming first-time buyers with practical tips is essential. This section provides actionable advice, ranging from budgeting tips to negotiation strategies, aimed at helping individuals navigate the complex process of buying their first home.

Navigating the BC Housing Market

In, the path to homeownership for first-time buyers in BC is riddled with challenges, but understanding the landscape and leveraging available resources can make the journey more manageable. This article serves as a comprehensive guide for those aspiring to overcome obstacles and achieve the dream of owning a home in British Columbia.

Click here for more visited Posts!